Posts

Setting Up New Ens Domain

Setting up ens domain The reason why I wrote this post is to just document the steps on how I broadly set up my eth domain here, https://jironghuang.eth.link

Steps First and foremost, I already have static pages that reside in this repo, https://github.com/jironghuang/jironghuang.github.io . The pages are served in my personal blog jironghuang.github.io . Second, register for ENS domain by following up the steps listed here, https://ens.domains/ . I registered for my domain jironghuang.

Nifty database framework

Database framework for sql queries, execute and rollbacks In database management, it’s useful to define atomic blocks. And let’s say if something fails within this block, you can always revert to the initial state before any of the transaction happens.

Below is a nifty framework,

Execute the query while not changing the state in the database. If there’re any errors along within the atomic block, you capture the error under exception area.

Highlights of 2020

Highlights of 2020 Developed forecasting system for hotel room supply and demand for COVID workstream in my previous day job. That’s meaningful! Quit my data scientist job in middle of 2020 to try and pursue a quantitative finance, systematic trading path. Spent the next half of year exploring and building up infrastructure for fully automated algorithmic trading and portfolio management. Deployed 3 trading strategies with 1 currency hedging feature.

Description of algorithmic trading and portfolio management infrastructure

Medium links to write-up on fully automated algorithmic trading and portfolio management infrastructure Algorithmic trading infrastructure for non options and options strategies Designing, Building and Deploying a Fully Automated Algorithmic Trading System: link How to place option spread (e.g. straddle) through Interactive Brokers API, a 101 tutorial: link

Performance monitoring features in fully automated algorithmic trading and portfolio management infrastructure Developing a performance monitoring component in my fully automated algorithmic trading system (part 1): link

Plans for trend following strategy in futures using continuous forecast

Trend following strategy in futures using non binary forecasts Project motivation As David Ricardo, a British economist in the 19th century once said, ‘cut short your losses and let your profits trend’ allude to the point that trend following as a profitable strategy could exist even back then.

Having read AQR’s papers on the Time Series Momentum (TSMOM, I am keen to explore this topic in the futures space (Moskowitz, T.

Developing a performance monitoring component in my fully automated algorithmic trading system

Developing a performance monitoring system for my algorithmic trading system It’s one thing to backtest your signals and forecasts on historical data but it’s a completely different animal in terms of execution. I have written about this here.

Another important component of setting up an algorithmic trading system is performance monitoring. Some important questions I had in mind while developing this component,

How do I measure my slippage? Commissions paid?

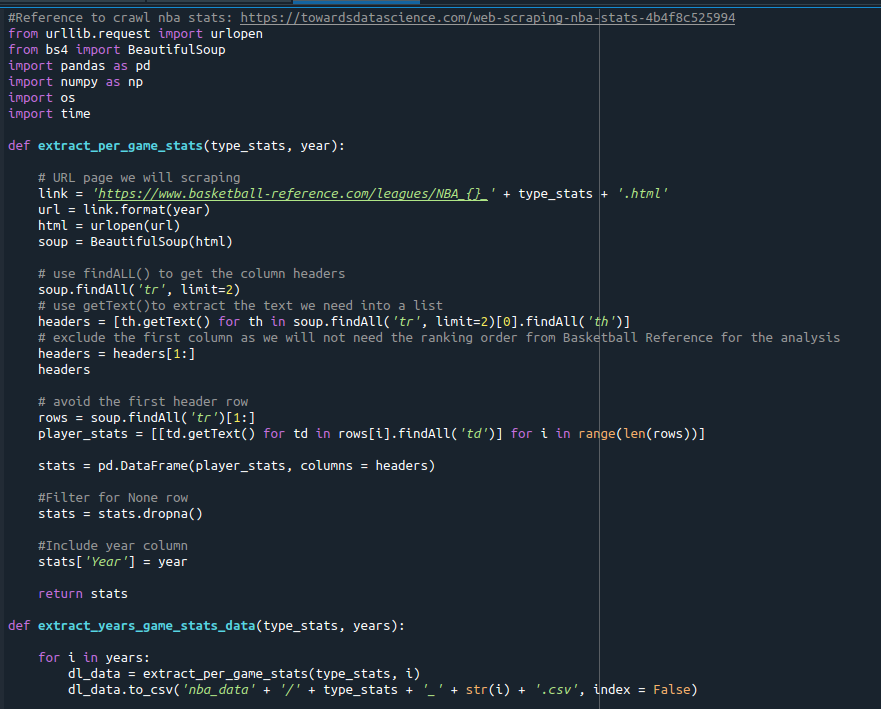

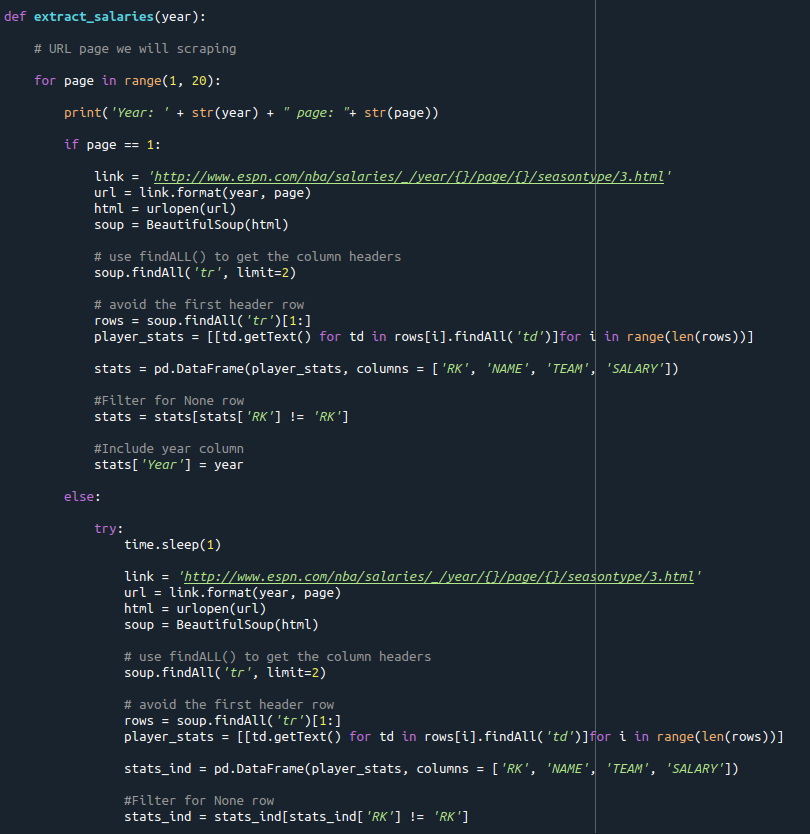

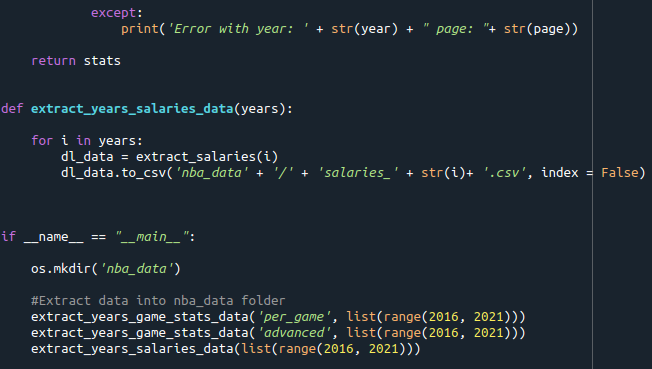

Crawling data from basketball-reference and espn

Crawling data from basketball-reference and espn

As I required some data for my ML assignment, I thought that predicting NBA player salaries based on previous seasons’ game stats would be cool.

Here’re the codes used for crawling the data from basektball-reference and espn.

Codes

Designing, Building and Deploying a Fully Automated Algorithmic Trading System

Designing, Building and Deploying a Fully Automated Algorithmic Trading System As I developed several inter-day trading/ portfolio management algorithms, I also embarked on a journey in parallel to develop a fully automated execution framework that could satisfy my requirements.

Previously orders were executed manually after signals are generated automatically.

Requirements A relatively slow trading system triggered by an hourly task scheduler during trading hours. I’m using Linux cron jobs for this.

Could volatility targeting increase risk-adjusted returns for quantitative strategies

Volatility targeting could potentially increase risk-adjusted returns for quantitative strategies Note: Man AHL’s framework in this paper is used in the write-up here.

Let’s say you researched and managed to find a quantitative strategy that suits your risk-reward preferences. How do you further improve your strategy while managing your risk?

A common way in the trend-following and risk parity space is to target risk - also known as volatility targeting.